tn franchise and excise tax mailing address

TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Job Tax Credit Business Plan RV-F1308601 918 Taxpayer Name Account Number Mailing Address Number of New Jobs FEIN Capital Investment and Job Creation Investment Period. Sales tax collections were up 114 from July 2021.

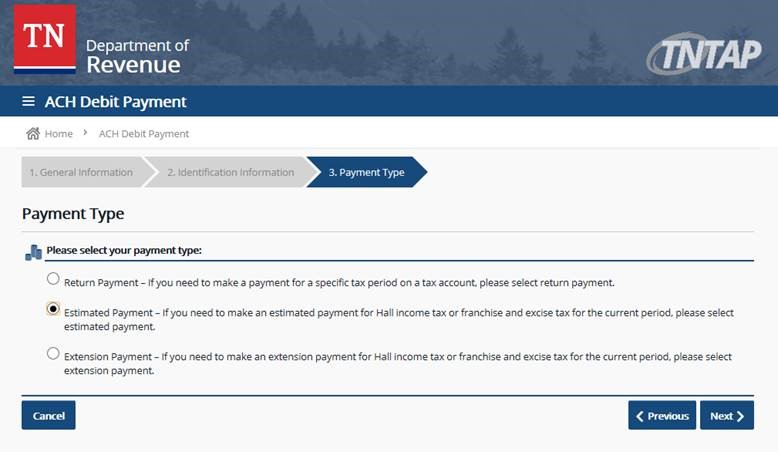

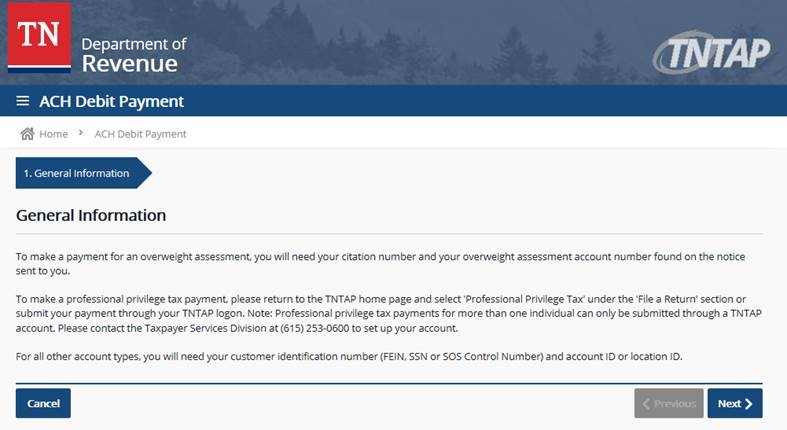

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Franchise Excise Tax Return Mailing Address Tennessee Department of Revenue Andrew Jackson State Office.

. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence. Input the Contacts name phone number and email address. We last updated the Franchise and Excise Tax Return Kit in February 2022 so this is the latest version of Form FAE-170.

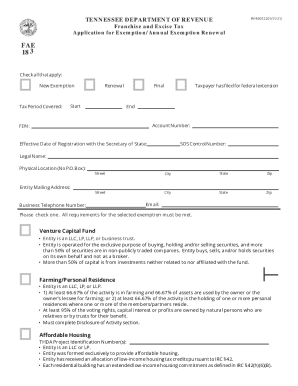

FE-5 - Due Date for Filing Form FAE170 and Online Filing Requirement. FE-6 - Application for ExemptionAnnual Exemption Renewal Form FAE183 Due Date. The Franchise Excise Tax return FAE 170 can be filed as an amended return.

According to the Tennessee Department of Revenue website all state returns need to be filed electronically. For Account Type choose Franchise Excise Tax. Download or print the 2021 Tennessee Form FAE-183 Franchise and Excise Tax Annual Exemption Renewal for FREE from the Tennessee Department of Revenue.

Contributors are members of. Although TaxAct supports Tennessee Form FAE 170 Franchise and Excise Tax Return in our Business products 1065 1120-S and 1120 we do not currently support this form in our Individual 1040 and Estate Trust 1041 products. Taxpayer Services 500 Deaderick Street Nashville Tennessee 37242 Phone.

FE-4 - Tennessee Filing Requirement for an LLC that Files Federally as an Individual or Division of a General Partnership. Please view the topics below for more information. Box 1214 Charlotte NC 28201-1214.

The account number may be found by using. How is Tennessee excise tax calculated. 8 hours agoThe largest factor in the overage is sales tax collection which finished the fiscal year 25 billion more than estimated and was 2447 million more than estimated in July.

Fill in payment details. Overall Tennessee collected 16 billion in July which is 3036 million more than estimated. If you qualify for the exemption to the electronically I have put the addresses below.

Tennessee - Form FAE 170. Mailing address FEIN and franchise and excise tax account number. All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax.

Sales and use tax. Physical Location No PO. TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Job Tax Credit Business Plan RV-F1308601 918 Taxpayer Name Account Number Mailing Address Number of New Jobs FEIN Capital Investment and Job Creation Investment Period.

Street City State Zip Street City. Rental Property Investing Short-Term Rental Long-Term Wealth The Multifamily Millionaire. Mary Van Leuven JD LLM is a director Washington National Tax at KPMG LLP in Washington DC.

TENNESSEE DEPARTMENT OF REVENUE Franchise and Excise Tax Return Tax Year Beginning Tax Year Ending Amended return Mailing Address City Legal Name State ZIP Code FEIN Account Number Final return for termination or withdrawal Application of Public Law 86-272 to excise tax Taxpayer has made an election to calculate net worth per the provisions of. ET-3 - Federal Section 179 Depreciation is Deducted for Excise Tax. FE-7 - The Date an Entity Formed Outside of TN Becomes Subject to.

Online Filing - All sales tax returns must be filed and paid electronically. State Tax Forms. Qualified Production Activity for Franchise and Excise Tax Credit The Tennessee Film Entertainment and Music Commission has been provided information describing the basis for.

ET-2 - Federal Bonus Depreciation is not Deducted for Excise Tax. A new excise tax will apply to redemptions of stock by publicly traded corporations that occur after Dec. 163 j in Relation to the Excise Tax.

To determine your account number for other tax types please contact the Taxpayer Services Division at 800 342-1003 in-state or. ET-1 - Excise Tax Computation. Excise tax on stock redemptions by publicly traded corporations.

You can search for your account number for the following tax types on Tennessee Taxpayer Access Point TNTAP. In TaxSlayer Pro this form is on the main menu of the Tennessee Franchise Excise Tax return. The TN Department of Revenue Franchise Excise Tax webpage will provide everything you.

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. What is TN excise tax. Download or print the 2021 Tennessee Form FAE-170 Franchise and Excise Tax Return Kit for FREE from the Tennessee Department of Revenue.

Please visit the E-file and Pay section of our website for more. ET-4 - Interest Expense Limitation of IRC. Corporate Income or Excise Tax Tennessee levies an excise tax of 65 on net earnings of corporations foreign and domestic arising from business done within the state or on state apportionment of total earnings of interstate corporations.

ET-5 - Deductible Business Interest Expense Carried Forward from Tax Years 2018 and 2019. Franchise Excise Tax Registration. Tennessee Department of Revenue Attention.

Franchise and excise tax. Mailing Address Street City State ZIP Code. Fill in the Taxpayer ID Type ID and Account ID.

615 253-0700 1-800-342-1003 ln State Toll-Free E-mail. If you have questions about Franchise And Excise Tax Online contact. The minimum tax is 100.

For additional information about these items contact Ms. This tax is a new nondeductible 1 excise tax thats calculated based on the fair market value of stock repurchased by US. Name of Contact Person.

Tennessee Franchise and Excise Tax Annual Exemption Renewal Form FAE-183 PDF. Choose the Period this should be the filing period end date you want the estimated payment to be credited.

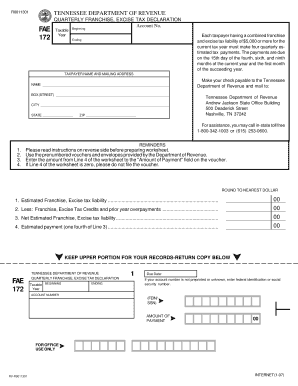

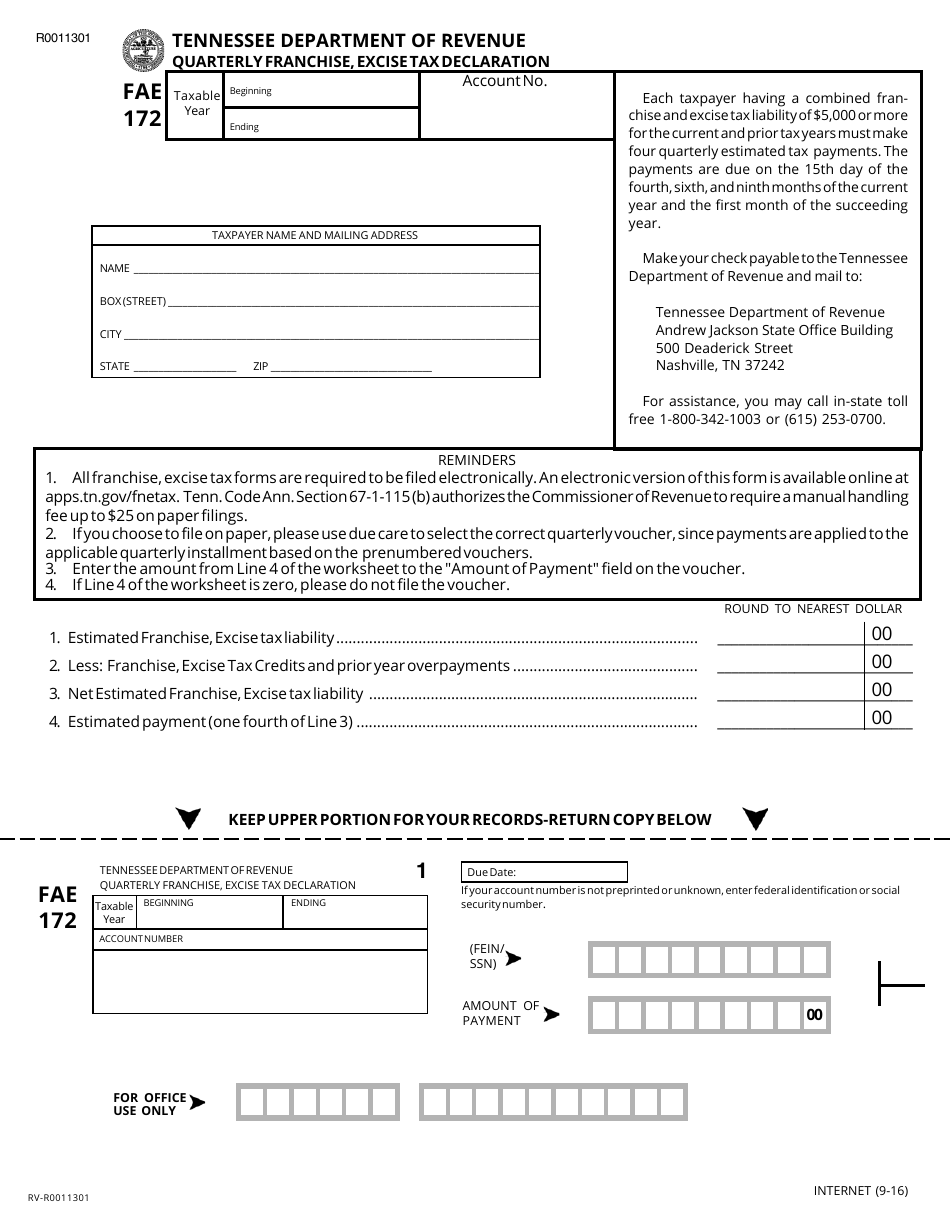

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

2017 2022 Form Tn Dor Fae 173 Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Forms State Of Tennessee

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Tn Dor Fae 170 2019 2022 Fill Out Tax Template Online Us Legal Forms

Tn Fae 172 Form Fill Out And Sign Printable Pdf Template Signnow

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Get And Sign Tennessee Department Of Revenue Franchise And Excise Tax 2021 2022 Form

Franchise Excise Tax Exemptions Farming Or Personal Residence Youtube

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Fae 170 Fill Online Printable Fillable Blank Pdffiller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Tennessee Franchise And Excise Tax Form Fill Out And Sign Printable Pdf Template Signnow